Since 2007 the website of Diamond Resorts International has made people think their personal six-night stay in heaven is only a few clicks away.

Online the company’s resorts, full of beaches and golf courses, still beckon. But Diamond is a 21st-century timeshare operation and investors ought to be wary of any company using the controversial vacation concept that has provided decades of fodder for comedy writers while troubling state and federal regulators.

Indeed what Las Vegas-based Diamond is selling is a sleeker, more expensive iteration called a vacation-ownership interest or VOI. And it seems to have proved successful for Diamond, at least thus far.

As is the case with buying a timeshare, customers purchase from Diamond the right to an annual one-week vacation at a resort. There are some important differences, though: Customers aren’t receiving a deeded right to a week’s stay at a specific resort. Rather, they gain the right to stay at a collection of company-owned properties in the United States, South America, Europe or Asia.

They can also buy a membership in a “trust” that allows for stays at other venues: When buying the vacation-ownership interest, they receive “points” that can be redeemed for a week’s stay — even at resorts and on cruises with which Diamond is affiliated but doesn’t own.

The concept of points is key. Think of them as a virtual currency, albeit one for which Diamond is both the dealer and the Federal Reserve. Purchasing more points means that a member has greater latitude to book a vacation, especially during peak seasons. It also means that the customer has spent a good deal of money.

In contrast, having a lower point total may require a member to reserve certain properties as much as 13 months in advance. Determining the price of points is part of the VOI negotiation process when a new member signs up. Thus, a point does not have a fixed dollar value: A chart, with data culled from member lawsuits against Diamond, seems to indicate that over the past three years the dollar value of a point has been trending lower.

Customers can expect to pay about $26,000 for a VOI for one week a year and about $1,460 in annual maintenance fees.

And a VOI is a so-called perpetual use product with a lifetime contract that’s difficult for a member to be extricated from — and there’s no resale market that he or she could tap for cash. The mandatory five- to 10-day cooling off period after a member first signs up is the only chance a customer has for canceling the contract before entering a lasting financial commitment to Diamond. (The company has said it may make some modifications to this policy in the future.)

Diamond faces considerable challenges in selling its main product — the VOI — given the current economics of the travel industry. Travel websites and apps like Expedia.com, Hotels.com and Airbnb frequently let would-be vacationers procure the equivalent of a Diamond resort stay for less than the company’s annual VOI maintenance fees. Many Diamond resorts even allow nonmembers to reserve rooms through consumer travel sites. But when a member relies on Diamond’s financing (banks don’t do VOI financing), this can push the combined annual maintenance fee and loan-payment expense to more than $6,000, a mighty price tag for a week’s stay.

Diamond disagreed with this assessment, arguing at length that focusing solely on cost sacrifices the value of convenience and flexibility.

One fact that Diamond’s management might not dispute is the warm reception investors and brokerage analysts have bestowed thus far. Rare indeed is the brokerage analyst who has not been impressed by Diamond has sustained growth trajectory: The company booked more than $954 million in sales last year, a spike from 2012’s $391 million.

And Diamond’s share price has steadily ticked northward, from $14 during its July 2013 initial public offering to $35 a year ago. This resulted in a $2 billion market capitalization when the company’s shares reached their peak value in February 2015. For the founding management and investment group that still owns more than 35 percent of the shares outstanding, this translated into over a $600 million stake at that time.

Yet in late January, a New York Times investigation showed that some of Diamond’s rapid growth might be due to overly aggressive sales practices. The Times article roundly spooked investors and almost $300 million of market capitalization was lost for more than three weeks before Diamond’s share price recovered. In response, the company issued a press release emphasizing its “zero tolerance” policy toward misleading sales tactics.

The Southern Investigative Reporting Foundation spent two months investigating Diamond’s murky soup of public accounting and disclosures to explore the financial mechanics of the company’s success. This investigation found that the financial statements have a very large red flag.

Simply put, there are a lot of close parallels to how subprime mortgage finance companies rapidly expanded in the last decade. The most obvious similarity lies in the drive to ensure a steady stream of borrowers whose down-payment cash will keep a company operating.

Diamond faces four interconnected problems: The company cannot survive on the amount of cash sales it makes, so it needs to finance sales. Diamond has to securitize those loans to bring cash in the door or run the risk of losing money on every sale. To retain favorable terms for monetizing its debt, the company has to use its own cash to make up shortfalls in the securitization pools. Since the realized value on customers’ loans is less than the amount Diamond has borrowed against them, it needs to monetize new loans faster and faster.

Recent history suggests that the fate of a company like this is not pretty.

(In an effort to provide readers a clearer view of Diamond’s responses, the company’s replies in full to specific questions have been embedded throughout this story. Of special interest are the replies supplied on Feb. 11, Feb. 12, Feb. 16, Feb. 17 and March 4.)

————————

Since 2011 Diamond has experienced a decline in its VOI sales to new members as a percentage of the company’s entire VOI sales (although the percentage did modestly increase last year from 2014). According to the just-filed 10-K annual report for 2015, 21 percent of last year’s VOI unit revenue came from new members. In 2011, that figure was 34 percent. What’s the reason for the broad decline? It’s not immediately clear.

Diamond dismissed a reporter’s recent question about the possibility of a decline in VOI sales to new members, citing the dollar growth of their purchases. (The estimated dollar value of new member sales did increase to about $148.1 million last year from $135 million in 2014.)

By contrast, new members at Diamond’s two biggest rivals, Marriott Vacations Worldwide and Wyndham Worldwide, accounted for 36 percent and 32 percent, respectively, of their companies’ VOI revenues last year.

Common sense would suggest that absent large blocks of new members arriving organically or through a purchase of a rival company, Diamond’s continually pushing current members to upgrade their VOIs will eventually result in diminishing returns.

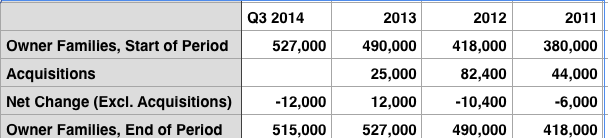

In addition, the number of “owner families” has decreased in three of the past four years. As owner families drop away from Diamond, the prospect of enticing existing members to upgrade their vacation owner interest becomes threatened. Diamond stopped reporting the number of owner families in the third quarter of 2014 without notice. An archived investor-relations Web page from June 2, 2015, tallied the number of owner families at 490,000, which is a decline to the level in early 2013.

Source: Diamond Resorts SEC filings

When asked why the company abruptly stopped disclosing the number of “owner families” in its public documents, Diamond replied that it has stopped providing the number because a large amount of its paying customers are hotel guests or use a so-called timeshare exchange network like RCI or Interval.

CEO David Palmer’s remarks about industry consolidation made during the company’s third-quarter conference call this past fall seemed to indicate that Diamond might be seeking additional acquisitions. When Diamond released its annual earnings report in late February, however, the company disclosed it had retained Centerview Partners to “explore strategic alternatives” — Wall Street shorthand for seeking a buyer.

Selling a company when its revenue grew at almost 12 percent last year and net income more than doubled is an unusual approach for a board of directors to take, especially since the shares nearly 50 percent off their highs. Managers with conviction about company prospects would ordinarily be seeking to add capital and expand the business or to borrow money to take the firm private.

Instead Diamond’s leaders seem to want an exit. What follows below is probably the reason why.

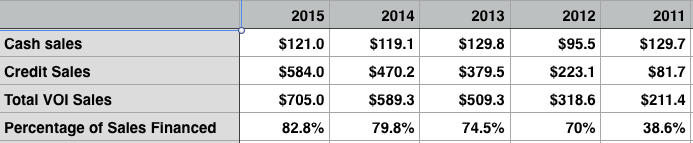

The 2015 10-K shows 82.8 percent of VOI sales had what the company calls “a financing component,” which can be compared with 38.6 percent in 2011.

Figures are expressed in thousands.

Source: Diamond Resorts SEC filings

The trend over the second half of last year is even more pronounced: In the third quarter, customers relied on company financing for 84.3 percent of VOI purchases. And in the fourth quarter, 83.4 percent of VOI purchases were financed this way.

Why should shareholders be concerned that almost 83 percent of Diamond’s customers last year borrowed money for their week in the sun? Because the credit crisis of 2008 is evidence that consumers with high fixed-cost debt can, in the aggregate, do grave damage to a company whose sales are reliant on financing.

When one checks numbers culled from Diamond’s November securitization, it takes little imagination to see how a VOI membership can quickly turn into a dangerous burden for a consumer. Consider this: The average loan in this securitization pool is for $24,878. When that amount is coupled with an 14.31 percent interest rate for a 10-year term, this locks a member into a $391 monthly payment. That’s $4,692 annually for the member — with at least another $1,000 in annual maintenance fees. (The 2015 10-K said the average VOI transaction size in last year was $26,007 and the average down payment was 20 percent, or $5,201.)

Diamond told the Southern Investigative Reporting Foundation that these are not regulated loans like mortgages but rather so-called right-to-use contracts it described as a prepaid subscription product without a real estate component.

(It’s worth noting that several paragraphs disclosing potential risks for investors were added to Diamond’s new 10-K about the potential for expanded Consumer Financial Protection Bureau regulation of VOI sales.)

Diamond argued in its filings that other members of the VOI industry offer their customers financing. But unlike Marriott Worldwide Vacation and Wyndham Worldwide, which financed 49 percent and 61 percent of their VOI sales last year, respectively, Diamond’s customer base appears to be dependent on it.

Make no mistake: Offering customers financing of as much as 90 percent of the price of a VOI has enabled Diamond’s rapid sales growth. With the amount of cash sales a paltry 16 percent to 17 percent in the second half of last year, this kind of financing keeps a stream of money from down payments flowing.

So to ensure working capital and manage risk, Diamond set up a securitization program. Chief Financial Officer Alan Bentley explained why securitization is crucial to the company’s needs during a presentation in March 2015, shown on page 21 of the official transcript:

“If I use an example that the customer did a $20,000 transaction with us, they’ve made a 20% down payment, which means we did a $16,000 loan. . . . Well, that 50% is on the $20,000 transaction, right. So you look that and say, ‘Okay, you got — you did $20,000 deal,’ you’ve got $10,000 out of pocket because you’re paying for your marketing costs, you’re paying for your sales commissions, et cetera. So that part’s out-of-pocket. So effectively, you’re upside down. Remember, so you got $4,000 down got $10,000 out-of-pocket. So how do we monetize that and get the cash? During the quarters, what we will do is remonetize that by placing those receivables into a conduit facility. Now that conduit, of course, is we have a $200 million facility and that $200 million conduit facility is we will quarterly place those receivables into that conduit, for which we receive an 88% advance rate, right. So we get that cash back at that 88% level on that — on the conduit.”

Whatever Diamond borrows from the conduit facilities is repaid when it securitizes its receivables.

When one looks from a distance, the program seems to have put Diamond in a virtuous cycle — of issuing high-interest, high-fee loans bringing in interest income and freeing up cash for its sales force to secure additional sales.

Moreover, the bonds that emerge from these securitizations have performed well to date. Then again, they should: Diamond typically has the option to repurchase or substitute in a new loan when a loan defaults (and use its own cash to make up a shortfall). According to the Kroll Bond Rating Agency, “Diamond has historically utilized these options resulting in no defaults on their securitizations.”

These VOI loans do have one truly unusual characteristic, though: Diamond’s members are paying off the loans much faster than their rivals’ customers. Wyndham’s VOI loans are paid off on average in about four years; Diamond members are paying off their loans in about 1.4 years. (In 2011 Diamond’s members retained a loan for about 2.4 years on average.)

But the problem with virtuous cycles is that they can spin the other way, too. If there are broad economic problems, borrowers might start wrestling with job losses or wage pressures and then the speed of prepayment might sharply decline. When that happens, typically the number of loans in arrears increase. If the prepayment speeds stay lower for long enough, Diamond — which has used its own cash and fresh loans in the past to help the loans in the securitization pools avoid defaults — might have to come up with a serious cash injection.

Diamond said its asset-backed bonds are prepaid so quickly because its customers tend to make VOI purchases while on vacation and, upon returning home, quickly pay off the loans.

SIRF’s reporting, laid out in detail below, suggests an entirely different answer.

After weeks of investigation, the Southern Investigative Reporting Foundation came across an obscure accounting rule called Accounting Standards Codification Topic 978, which went into effect in December 2004, that allows Diamond — or any timeshare company — to recognize revenue from upgraded sales even if the member doesn’t put any money down. New-member sales, in contrast, are accounted for only when at least 10 percent of the VOI’s value has been received.

If ASC 978’s logic is counterintuitive to outsiders, for Diamond’s management it is surely heaven sent. On the view that a timeshare purchase is a real estate transaction, an upgrade to a vacation ownership interest is considered a “modification and continuation” of the existing sales contract.

How does this work in real life? Say a new member purchases his or her VOI for $20,000 and puts $4,000 down, a 20 percent equity stake. If six months later that member seeks to upgrade to an expanded membership level that costs $20,000 and signs a sales contract to that effect, Diamond could account for this as a sale even if no money is put down.

That 20 percent equity stake, which is really now 10 percent given the $20,000 additional financed, is all the legal cover the Diamond accountants need since the upgrade is considered a modification and continuation of the initial timeshare purchases contract. Diamond’s computers can now record a new $36,000 loan to pay off the initial $16,000 loan and book $20,000 in new revenue. This appears to be why Diamond has such high prepayment of its loans.

If the whole things seems circular, that’s because it is. A lending facility that Diamond controls loans an existing member $20,000 and it goes on the books as revenue but not a penny of cash has gone into the coffers — yet. Plus, that initial $20,000 loan is now accounted for as fully repaid even if it is not: The member still owes $36,000 plus the hefty interest rate. And it’s completely legal.

So who is responsible for this accounting stroke of genius? None other than the senior accounting staff from the timeshare industry’s leading companies who proposed this new rule in 2003.

At the very minimum, ASC 978 should give investors pause about Diamond’s quality of earnings.

When asked if the new accounting rule had spurred the high prepayment speeds of its loans, Diamond pointed to its customers’ creditworthiness as the cause.

————————

Evidence is beginning to mount that some of Diamond’s borrowers are struggling with their obligations. Less than two weeks ago, Diamond disclosed a 45 percent increase in the amount of its provisions for uncollectible sales revenue in the fourth quarter of 2015 to $24.8 million from $17.1 million a year prior. In the company’s release, the jump was attributed to a change of certain portfolio statistics during the quarter,” suggesting some degree of credit performance woes.

The Southern Investigative Reporting Foundation asked the company to elaborate on the “certain portfolio statistics” that proved nettlesome and in a lengthy answer, it ignored the request to discuss the specific statistics behind the spike in uncollectible sales reserves but merely referenced issues that might have informed its decision.

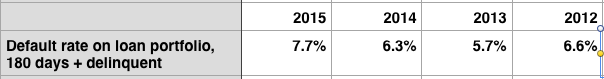

Nor is that the only data point that suggests looming headaches. The default rate on Diamond’s loan portfolio last year was 7.7 percent, the highest the company ever reported.

Source: Diamond Resorts SEC filings

Analyzing the health of Diamond’s loan portfolio is not a cut-and-dried exercise: Its rivals, Marriott Vacation and Wyndham Worldwide, wait 150 days and 90 days, respectively, before they charge off their bad loans; Diamond uses 180 days, a full two months longer.

Asked about why the company waits 180 days, Diamond said it’s a matter of internal policy and that there is no rule governing time frames for charging off bad loans.

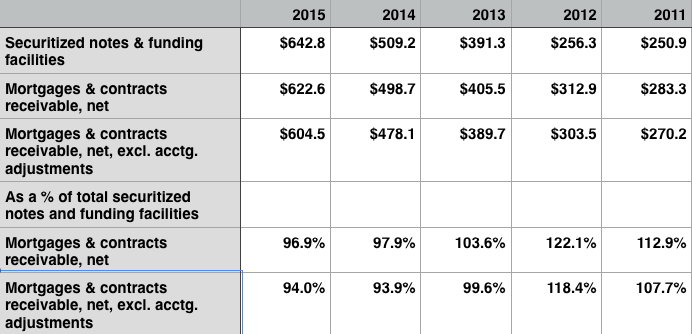

The more Diamond’s securitization program has expanded, the deeper underwater the company has become. In 2011 it reported $250.9 million in securitized notes and funding capacity against $270.2 million in receivables. This means that if the company had to pay off its bonds, it had a nearly $20 million surplus of money owed it to draw upon.

As the securitization program doubled in size, however, that surplus evaporated. Last year Diamond borrowed $642.8 million against a net receivables balance of $604.5 million, amounting to a $38 million deficit. In other words, Diamond would have to come up with cash rather than substituting loans to make its bondholders whole. (The Southern Investigative Reporting Foundation excluded adjustments because they were noncash accruals and assumed that receivables that weren’t securitized have a zero net realizable value, otherwise the $38 million deficit would be greater.)

During the same five-year period, the average seasoning of loans (the amount of time that the loans are kept on Diamond’s books before they are placed in a securitization pool) dropped to three months last July from 25 months in an April 2011 offering.

Figures are expressed in thousands. Source: Diamond Resorts SEC filings

Editor’s note: When the Southern Investigative Reporting Foundation first approached Diamond for a comment for this story by phone and email on Feb. 5, Sitrick & Co.’s Michael Sitrick responded as the company’s outside public relations adviser on Feb. 13. While his firm has a diverse and high-profile practice, Sitrick is traditionally associated with crisis communications. He also served as the outside spokesman for Brookfield Asset Management when it threatened to sue the Southern Investigative Reporting Foundation in February 2013.

Two Southern Investigative Reporting Foundation board members (while working for previous employers) have written about high-profile Sitrick & Co. clients like Biovail, Fairfax Financial Holdings and Allied Capital.

Correction: A previous version of this story mischaracterized a letter written by the VOI trade association to the Consumer Financial Protection Bureau. The related paragraph has been deleted.

Ref Diamond Resorts

We are EU owners. DRI has a new line. It has banned sales from updates for 18months from Jan 4. It asks members to go for purely information updates and then tells you that prices will e locked for 18 months at £X pp and the price will go up during that time by a factor of 2.5. During this charade an accountant comes in and tells you that,quite inexplicably, a previous offer which is 1/3 of X is still on the books. He tells you to sign a price of paper withdrawing from this and to sign another locking you into the higher price.

You will probably then refuse and this will open the doors for you to exercise you fortunate option on the lower price. This happened to me and we were even put under pressure to buy half the number of points that we had been offered.

Just one big scam and many Brits are electively blind to it.

Thank you

My husband and I are Diamond owners. We have repeatedly asked to be taken off their call list. When we checked into Grand Beach Orlando in 2015, we were asked to attend a group presentation. Three times I asked if we would be paired with a commissioned sales person and three times we were told no. They said we would talk to a commissioned agent only if we had questions in the last ten minutes. The appointment form for the “non-sales” presentation said in fine print we were agreeing to be “robo” called. We did not sign the form but are still called almost daily. When we went to the reception area for the non-sales presentation, we were greeted by a commissioned sales agent. After the 55 minute guaranteed non-sales presentation, we were high pressured for another three hours by increasingly sophisticated sales people. There needs to be greater disclosure calling it what it is. It’s not an owner’s update. It’s a sales presentation. Why have an owner sign off on a 55 minute presentation, when they are held hostage for an additional three hours. No one asked us to sign a form agreeing to that! I encourage people thinking about investing in Diamond to google Diamond Resorts complaints and DRIP which stands for Diamond Resorts International Protesters. The website was started by 1,000 British owners trying to get out of their ownership. If life lands you a hard blow, owners are charged 18% interest the day they are late on an investment they can’t sell. Diamond encourages their owners to think of their points as a second home. What second home would you buy that could not be sold. We are not unhappy with the program, but would get out if we could due to very high pressure tactics. We would like to stay in NYC, but points required would be 20,000 (in February). This would be equal to $4,000 in our maintenance fees for a room at the same hotel that could be booked for $1,100 for the same week, including taxes. We have no problem with availability if we want to stay in Orlando or the Ozarks, which we don’t. We enjoyed time share for 28 years until we learned what we will have to go through every time we check in at Diamond. My husband just turned 78 yesterday. He received a Happy Birthday time share solicitation to buy more points. I would be ashamed to own stock in this company or any of their competitors after reading complaints from real people behind the $24.8 million 4th quarter uncollected vacation interest provision from Diamond and from their competitors. It’s just a number to them. Until there is a legitimate secondary market, too many people can be hurt.

Great write-up. Even a slow brain like mine now understands the intricacies of DRII’s business which I never had explored.

Looks like investors are extremely worried about their business as well with short interest steadily climbing over the past year.

http://www.nasdaq.com/symbol/drii/short-interest

This report is misleading at best and full of inaccuracies, as listed below. In summary, your article does not articulate a reason that Diamond’s equity (DRII) should trade for a 50%+ discount to its peers, Marriot Vacations (VAC) and Wyndham (WYN). I suggest readers carefully review the author’s notes, which are provided through links throughout the report, to provide better context and a clearer picture.

1) You stated “troubling state and federal regulators” and provided a link that leads to an article about fraud in timeshare resale, which are “telemarketing companies that market their advertising services to timeshare owners interested in selling or renting their timeshare interests”. This is effectively the opposite of Diamond’s business, which is selling the timeshare ownership to these owners initially.

2) You stated “the dollar value of a point has been trending lower” and provide a link to a chart. The chart is difficult to read without headings, but the annual decline in “value per point” from your first data point in 2008 to your last in 2014 is ~5%. This equates to it costing a consumer 5% more each year to buy the same number of points. Stated differently, it is inflation coupled with pricing power. How many good companies do you know that have raised prices 5% per year? To be clear, the “value of points” has not declined, but only the cost of those has risen. If I buy 10,000 points for $25,000 today, those 10,000 points will always get me access to the same resorts. However, someone next year will have to pay more for those same 10,000 points. I am confident that you’ll find all of Diamond’s peers, like most good companies, raise prices each year.

3) “One fact that Diamond’s management might not dispute is the warm reception investors and brokerage analysts have bestowed thus far”. False and to my initial comment, Diamond’s shares trade at a 50%+ discount to peers and only briefly at its peak did they trade inline, so I would not characterize that as a “warm reception”.

4) “The company cannot survive on the amount of cash sales it makes, so it needs to finance sales”. False. In fact, from 2008 to 2009, it did just this with ~70% sales paid in cash. Economics 101 would tell you that your preference would be to allow consumers to finance sales once you are comfortable with their credit profiles because they are able to generate cash off the sale AND financing of those. Providing financing also enables more consumers to have access to timeshare ownership.

5) “Diamond has to securitize those loans to bring cash in the door or run the risk of losing money on every sale”. False. They have conduit facilities that provide financing and could rely on these, but the advance rates are better on securitizations.

6) “To retain favorable terms for monetizing its debt, the company has to use its own cash to make up shortfalls in the securitization pools”. False. They have never injected cash into their securitizations. In fact, they have among the highest rated securitizations in the industry.

7) “Since 2011 Diamond has experienced a decline in its VOI sales to new members as a percentage of the company’s entire VOI sales”. Misleading and as you correctly then state because sales to existing members has grown. Also, the inverse of this comment is sales to existing members as a % of the total has increased. If the company is so terrible, then why are more existing members adding points?

8) “By contrast, new members at Diamond’s two biggest rivals, Marriott Vacations Worldwide and Wyndham Worldwide, accounted for 36 percent and 32 percent, respectively, of their companies’ VOI revenues last year.” Misleading. Those peers did not acquire 49 resorts in the past five years. Part of Diamond’s strategy has been to acquire resorts and then bring those members into their system. Including these acquired members, sales to non-existing members is 40%+.

9) “In addition, the number of “owner families” has decreased in three of the past four years.” Not clear that is true. They had been including families of acquired entities that were not current on maintenance fees, which should not have been included in the first place.

10) “CEO David Palmer’s remarks about industry consolidation made during the company’s third-quarter conference call this past fall seemed to indicate that Diamond might be seeking additional acquisitions.” False/misleading. Hence, the company made two acquisitions following these comments.

11) “Selling a company when its revenue grew at almost 12 percent last year and net income more than doubled is an unusual approach for a board of directors to take, especially since the shares nearly 50 percent off their highs. Managers with conviction about company prospects would ordinarily be seeking to add capital and expand the business or to borrow money to take the firm private. Instead Diamond’s leaders seem to want an exit.” Misleading. As you so aptly pointed out, the company’s financial results have been impressive yet the stock is down 50%. Management recognizes this disconnect and is therefore pursing strategic alternatives to find a private buyer that appreciates their true value. Given their significant ownership stake and appreciation for their true value, I believe it is highly unlikely that management will “exit” and instead will borrow to effectuate a buyout. It is standard for a board to run a formal process once management expresses an interest in a buyout because management and the board do not want to be sued by shareholders claiming management “stole the company” at a low price. THIS POTENTIAL FOR A BUYOUT IS THE GREATEST RISK TO SHORTING THIS STOCK.

12) “But unlike Marriott Worldwide Vacation and Wyndham Worldwide, which financed 49 percent and 61 percent of their VOI sales last year, respectively, Diamond’s customer base appears to be dependent on it.” Misleading. Unlike its peers, Diamond does not include cash down payments in its calculation % of sales financed with debt. With an average down payment of 20%, this implies that ~66% of Diamond’s sales are paid with cash, so much closer to its peers.

13) “If the prepayment speeds stay lower for long enough, Diamond — which has used its own cash and fresh loans in the past to help the loans in the securitization pools avoid defaults — might have to come up with a serious cash injection.” False. It has never injected cash. It has simply replaced loans refinanced with new loans. Also, and more importantly, Diamond is not required to use cash and loans but to simply re-market for new loans to replace those under default.

14) “The default rate on Diamond’s loan portfolio last year was 7.7 percent, the highest the company ever reported.” False. Pg. 9 of its most recent 10-K specifically states it has ranged from 5.7% to 8.2% since 2011.

15) “Its rivals, Marriott Vacation and Wyndham Worldwide, wait 150 days and 90 days, respectively, before they charge off their bad loans; Diamond uses 180 days, a full two months longer.” Misleading. It should not change the calculation of net receivables and simply means the bad debt reserve should be lower for peers, as articulated in the note you provide in a link.

16) “The more Diamond’s securitization program has expanded, the deeper underwater the company has become…. As the securitization program doubled in size, however, that surplus evaporated. Last year Diamond borrowed $642.8 million against a net receivables balance of $604.5 million, amounting to a $38 million deficit. In other words, Diamond would have to come up with cash rather than substituting loans to make its bondholders whole.” Misleading and false. The company had $770mm of gross receivables as of 12/31/15, which is the appropriate number to compare as opposed to net receivables. A company that has grown free cash flow per share by double-digits for each of the past few years while issuing some of the highest-rated securitizations does not describe one that is going “deeper underwater”.

17) “During the same five-year period, the average seasoning of loans (the amount of time that the loans are kept on Diamond’s books before they are placed in a securitization pool) dropped to three months last July from 25 months in an April 2011 offering.” Misleading. Last year marked the first year that they had sufficient receivables (due to successful growth) to access the securitization market twice, which is a positive because it results in loans being converted to more cash quicker.

you don’t have to do the owner updates. you can say no. and after 90 minutes I got up and left and told them I was told 90 minutes and I had other plans. I left with my “gift” and have never done another owner update. even though they ask me each time I check in.

Thank you for the facts, but you aren’t mentioning a few simple observations.

If the vacation club ownership was any type of a great deal, then how can you explain that they have ZERO value. People are trying to simply give their ownerships away. Go to facebook, google it under dri groups, forums.

With regard to maintenance fees, even more ridiculous is the 5% increase of fees. If it were merely 5%, a large number of owners would not be looking to give their ownership away. If you had a membership in 2010 or 2012. Your maintenance fees are 50% to 75% more than they were. So your numbers are incorrect again. If they had all this cash on hand it’s because of the ridiculous yearly maintenance fee increases. Again, not 5% a year.

In some cases they have increased the number of points needed at certain resorts. They also changed the rules on how they operate for Silver/Platinum ownerships. They used to have points discounted at all resorts within 60 days or less of reservation date, no longer is this the case, unless they want to. They now charge to add a guest to a reservation, a benefit that was free until this year.

They are also manipulating inventory. I have known a few people including myself where my points were missing from our accounts. One person it was 9 months before points were return and another it was 7 months. I’m on month #1. The manipulation of inventory is obvious because you can look online at on the online booking sites to see diamond resorts/properties available through these venues. BUT, there is no availability for an owners to use their points from their ownership, plenty of units and unit sizes available to rent. Yeah, they are going to try to say something about developer units, well then, I guess it’s ok to rent units by anyone if the developer/management is allowed to do rentals, so that doesn’t make it right. What’s worse, the amount they are charging for the rentals are less than what it would cost for an owners maintenance fee cost. In other words, for 2 nights it may cost 3000 pts or the equivalent to about $500 in maintenance fees, but yet, the online rental may cost $300 for the same 2 nights. This again is just plain wrong for the sake of making a higher profit to eventually sell the company. Again, obviously when an owner can’t find availability in their ownership dashboard online; more and more owners are realizing what they own would be a lot cheaper if they just rented directly from an online booking source. Heaven forbid if an owner has a mortgage and yearly maintenance. A double whammy. No wonder so many owners would rather just get rid of their ownership than recoup any money.

With regard to the notion they aren’t using owner updates to pay off one loan to get an owner into another loan is blatantly naive. That piece of work makes it look like 100% of a loan was paid off, then another loan was activated for accounting purposes, which you can use to slant to your best advantage. Such as knowing you were going to sell to make your company look a lot more valuable.

There possibly has already been a lawsuit against Diamond in the EU or some sort of regulation in the EU because of there predatory actions against their timeshare owners.

When someone speaks of other ownerships, Marriott Ownerships may cost nearly the same as a new diamond owner. The Marriott properties are much nicer than the Diamond properties, therefore it’s not really apples to apples. Marriott also doesn’t mark up their yearly maintenance fees at 10%-25% per year. They also aren’t trying to rent out their owners use online. Wyndham, Diamond, Bluegreen all do the deceptive practice of renting owners use with online booking sources. Wyndham raises their yearly fees just as Diamond does, they are nearly identical in their predatory practices against owners.

Bottom line, diamond got out in the nick of time with a high valuation. They have already priced their product out of the market place. A low amount of points good enough for 2 weeks a year best case scenario cost over 25,000 to finance, plus maintenance fees will be over $2500/yr. In this day and age of internet discount pricing and being able to book instantly, there is no way they can keep raising their prices or refinance people into a larger ownership of $35-$50k with a great amount of success. The cash they get as down payment will not recover enough for expenses of the entire company, so going public was the perfect escape, plus previous financing. All that mumbo jumbo is just that. This is just like a home mortgage except you own a few days to a few weeks and the costs rise and you own nothing. You can’t sell it for any amount of money to recoup money, so it’s not an investment of any sort. It’s throwing money down the drain ultimately. Google online diamond points sales and people are just wanting OUT. When enough of your customer base wants out, sooner or later there is a tipping point of no return.

If only one adult checks in and says their spouse is not with them, they will not do an owners update. I sometimes travel by myself or with friends instead of my spouse and I never have to endure an owners uodate.

Dear Mike

Thanks for that, we attended a presentation ( a Diamond Discovery Overview according to their T and Cs) last week. Even after reading what you had to say, we were taken by surprise. The second salesman came up with a document showing we had attended a ‘Points Auction’ at a holiday in Cromer we took in 2014 and could still buy at £1 per point. Unfortunately, he chose a holiday which we had booked for our daughter so we weren’t actually there. Thanks to you, we signed his waiver form quite happily despite all protestations. We found the presentation very worrying and intimidating and we will not be going back for another.

Anthony

Dear Irene

I have read a number of your articles about Diamond membership. My wife and I have deliberately avoided attending any of their presentations since the Fractional Ownership sales pitch several years ago. This year we were offered by e mail a reduced rate vacation at Pine Lake, one of the T and Cs being that we attend a presentation (a Diamond Discovery Overview). Having read what Mike (above) had to say, we went along. It went just as he said, and we signed their waiver form quite happily despite their protestations. As a Diamond member from across the pond, if there is any useful information I can provide for you, let me know.

Anthony

Hello to all who read this. On August 14, 2016 we brought into Diamond International Resort(DIR) in Virginia Beach at the Discovery Center. At that time we purchased a 4000 points package which we were told was more than enough point to stay during peak season in Va Beach. Just this weekend Nov 18,19,20, we were scheduled to go back for our first orientation to see how the program worked. When we sat down with the first representative Tino Piazzola he told us that we have a problem…How were we able to buy 4000 points when they start at 8500 point? Red flag automatically went up. We replied they was sold to us by the VP of DIR introduced to us as Tony Milazzo. Tino Piazzola got up from the table and went an got another rep who was identified as the manager above him (Eric last name unknown). We explained to Eric the same scenario…Eric then went and got another rep who was introduced to us as Mike Hill. Neither of those managers did not provide any help. After that another manager who was introduced as James Swetson second to the VP. He stated that the packages do not go lower than 6500 points. All four reps agreed that we was under sold our vacation package but they could not do anything about it. The only resolve they offered was to contact corporate or to purchase additional points. However purchasing additional points meant we had to triple the additional points needed to stay during peak season. If the correct package was presented in the beginning this would not be an issue. You would think with all theses managers and VP someone should have the authority to correct a mistake made by DIR. Instead we continuously got the run around a 120 minute presentation turned into 5 hours with no help from any of them. The time we sat in the discovery center listening to sell pitch after sell pitch giving to different visitors throughout the center they falsely being lead to believe in DIR. Just a way of making the quota. Bottom line is this…what ever happen to service before self. I was lead to belief in DIR and mislead by the VP of the company. We even asked for help to register our account no one knew what to do and the response we got was that’s not my job. Sorry to say to you Mr. CEO David Palmer at your Virginia Beach location you have a group of incompetent people working at that location.

The management at Diamond Resorts are absolutely crooked. They pay off legislatures to remain in business. The government need to step in and straighten it our before more innocent victims get screwed out of 10’s of thousands of dollars. Over the past 8 or 9 years most of the timeshare companies have taken actions to make the timeshare or points you buy absolutely worthless as soon as the grace period of 5 days is over. So the $30000 or $50000 goes to absolute zero value in 5 days. You will even have to pay someone to take it from you. If you have to get a loan the screwing is much more terrible. The agreements you sign to get these investments are also worthless and you have to sue them to live up to them. Figure $30000 for lawyer fees. The rules you are supposed to follow change on a daily basis. Renting out your point or timeshare week that are in some old contracts are no prohibited and their response it to cancel any open reservations. They will then take back your points or timeshare and resell it for $8 or 9 dollars a point to some other sucker. They should be put in jail for a long time.

Through eBay and and timeshare rental sites, I have been able to stay in many 1 or 2 Bedroom Condos for Spring and Summer vacation for weeks at a time for a fraction of what many “owners” are charged for their annual maintenance fees. I have been doing so successfully for the last 15-20 years. I have stayed in Condos in Cancun, MX Florida Keys, Orlando FL, Destin FL, Myrtle Beach SC, Gatlinburg TN, Hot Springs AR, Branson MO & Ozarks, French Lick, IN, etc. sometimes multiple times at each destination, and always when I wanted to, regardless of “peak” or “off-peak” seasonal conditions – Spring and Summer breaks, and always via rental. I am not currently, nor have I ever been, a timeshare owner. Oftentimes the weekly rates averaged less than $400/week, and most frequently were for two bedroom untis, although occasionally I have also opted for 1 Bedroom or even studios apts. for my family of four. As an example, this Spring Break, I am staying at the Diamond Resort Mystic Dunes for 5 nights in a 1 Bedroom Condo for which I paid $199 on eBay. So that works out to about $40/night. I do not know how the timeshare business stays afloat, as even the cheapest Motel 6 in Kissimmee is $60/night not to mention hotel & sales taxes etc. I have attended any number of Timeshare presentations, but at this point, with all of the options available to me, including now Air Bnb, why would I ever pay for a Timeshare or a deed? I am wondering when the “house of cards” that is the Timeshare Industry finally collapses under it’s own weight and the abuse of it’s owners? In the mean time, those unfortunate owners who have grossly overpaid for deeds have helped subsidize many of my family’s vacations by virtue of the resale of excess or unused inventory. Thank you Timeshare owners, one and all?

We went to Orlando, FL and the exact same scenario happened to us. We were told 4,000 points would be more than enough to have a great vacation each year. We had to do the mandatory member orientation and they told us we could not vacation for that amount and we had to buy up. We just wanted them to teach us how to book. Their systems were down at both meetings. I feel like we were have been roped into this debt for years and we don’t even know how to use the points. We were tricked and lied to and our money was stolen by good on artist. We have no recourse.

Hi

We r in the same boat!!!

On our way to “mandatory” meeting in Missouri.

13 hour drive.

Told we had to attend!

We r both in 70’s.

We feel we were deceived and now in debt for $24,000 plus maintenance fees.

Is there a way to get out of this.

We were really stupid!!!

I really don’t think they should be allowed to be sold. I use to have one. But I as well had to pay someone to get me out of them. They are a rip off, and I think they all deserve to go to a special place. I wish I remembered the companies name that helped me. I don’t have a clue who they were. I have their number in my phone under “timeshare cancel” . Don’t know if they are even still around. They were in Missouri. 417..409..3209 . It cost a lot but they got it done. I wish you all the well. I currently have a second one that I hung on to cause my wife wanted to for some reason. It is with Bluegreen. And I just seen where basspro sued them for 10 million dollars. So I think that’s the final straw for me. If Bass Pro is suing people they have to be scammers. Johnny Morris is a great all American guy.