With Valeant Pharmaceuticals’ evolution from battleground stock to full-bore Wall Street circus, it is easy to forget that underneath the competing valuation narratives and regulatory drama is a real operating company.

The odd thing is that down at the operating level — where drugs are made, shipped to market and sold — things don’t get very much clearer.

One of Valeant’s more enduring riddles is the continued vitality of Wellbutrin XL, a drug that has been off patent since 2006. A January Bloomberg News article ably laid out Valeant’s strategy of constantly raising prices on the drug — 11 times since 2014 — that underscores how revenue jumped.

But looking at Wellbutrin XL’s prescription count data from the second and third quarters last year — specifically the reported revenues — some unanswered questions remain.

For instance, the third-quarter Wellbutrin XL prescription data captured by Symphony (and available via a Bloomberg terminal) indicated that the count declined by 2,743 prescriptions, to 67,312 from 70,055.

The decline in Wellbutrin XL’s prescription count makes plenty of sense since there are numerous factors working against the brand — the aforementioned price increases and additional generic competitors hitting the market after the Food and Drug Administration put to rest bioequivalency concerns.

What doesn’t make sense is how revenues increased 37.3 percent sequentially, jumping to $92 million from $67 million. It seems we can rule out Direct Success, the Farmingdale, New Jersey-based specialty pharmacy that fills Wellbutrin XL prescriptions for low (or no) patient co-pays and then works to secure reimbursement, as the channel for the difference.

While Direct Success is the obvious candidate to explain any discrepancies since data reporting services don’t capture specialty pharmacy prescription activity, Valeant itself ruled this possibility out when spokeswoman Laurie Little told Bloomberg News, “[Direct Success] accounted for less than 5 percent of Wellbutrin XL sales.” She also remarked that there were other channels where the drug is sold, including “Medicare, Medicaid and the Department of Defense.”

It is very unlikely that these channels factor into the Wellbutrin XL issue. Centers for Medicare & Medicaid Service contract awards are heavily contingent on price and the Department of Defense even more so; many Medicare Part D plans don’t even cover the brand. Here is a DoD contract out for bid, for example, and here is the (generic manufacturing) winner.

(As the Southern Investigative Reporting Foundation was finalizing reporting on this article, Wells Fargo research analyst David Maris released a report that mentioned Wellbutrin XL’s unusual performance in the third quarter of 2015, among numerous other issues. While ordinarily it would be unusual to be beaten to the punch by a sell-side analyst, Maris is an exception, having — ironically — caught Valeant’s corporate forbear Biovail Pharmaceuticals in a revenue inflation scheme. In full disclosure, I also reported frequently on Biovail, a legendarily clogged corporate toilet.)

One area that merits consideration is some sort of channel stuffing, wherein distributors are sold more drugs than they can presumably sell themselves.

Consider pharmaceutical distributors, who have very narrow operating margins (given the nearly riskless nature of their business) and whose business model benefits mightily from distributing drugs where price increases are regularly announced. This allows them to purchase drugs in advance of the scheduled increase and profitably resell them at a higher price.

For a manufacturer, aggressively moving extra inventory into distribution channels bears little risk: The profit on incremental volume moved is huge and it is effectively zero-interest financing since the company gets cash up front and simply return it to the distributor if product is unsold. The risk is that a manufacturer’s distribution networks have too much of a product and sales decline until inventories clear out. To be sure, there is a long history of pharmaceutical companies improperly handling the accounting related to drug distribution.

Inventory reduction has certainly been on Valeant management’s mind.

At a December analyst meeting in Newark, then-chief executive officer Michael Pearson spoke about “bringing down the inventories in the wholesale channel,” “the continued impact of the reduction in channel inventories” and referenced getting “normalized in 2016.”

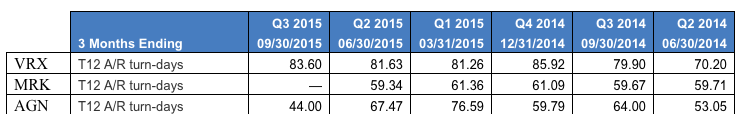

Valeant’s days sales outstanding do appear high as the chart below indicates, even adjusting for the inventory that came on balance sheet in April when the Salix purchase closed. (In December, the Southern Investigative Reporting Foundation released an investigation into Valeant’s unusual Eastern European distribution practices.)

On Friday afternoon the Southern Investigative Reporting Foundation submitted questions via email to Valeant outside spokeswoman Renee Soto of Sard Verbinnen & Co. She did not reply by press time.

Whats you take on all the other drugs? Wellbutrin XL accounts fro $92M of sales which if you restate to 0$ is maybe 1% of on 8,263.5M of Revenue. I dont get the huge concern. I suppose one could argue where there’s smoke there’s fire..but you have to pick a more juicy target than 1% of revenue.

The answer is simple, those of us who suffer from depression and used Wellbutrin before generics were available found that when we switched to generics our symptoms returned. The generics do not work and to get relief from our symptoms we must use the name brand.

Yes, I agree with you about the Wellbutrin vs. Generic Wellbutrin. I am on Medicare and my Medicare Part D plan that I have does not pay for the Brand name Wellbutrin.

Agree with above comment. Generic Wellbutrin is crap and we should be able to have the choice between generic and brand name. I don’t even mind paying more out of pocket.

I am Medicare and Medicaid with extra help, and can not believe the greed of these companies with this medication especially! I can’t even find a pharmacy to fill it because they lose money! This is out of control in this country! Especially when most of the meds are actually coming from almost unregulated factories in other countries! I have many drug sensitivities, and all that matters is the cheapest the pharmacy can get from wherever! Making us sick or not working at all! This government and f da need to stop this price gouging kickback, ignoring and not regulating the prices or even what is in these pills! It’s prosperous! And needs to CHANGE!

I have taken Wellbutrin when there was no xl formulation. I’ve attempted to only take Brand as Pharmacy messed up and ordered Generic. After two month, I do a self assessment and I was getting depressed. I have ADHD, age 56, female, but Wellbutrin Brand has only worked! I was prescribed 300 xl in January 2018, and have determined I do better on the 150xl 2x daily. I would recommend if at all possible getting the Brand Wellbutrin, Your older person who Has been there and swear by Brand! Hope everyone is doing well

Brand Wellbutrin XL cash price for a 90 day supply is over $5,000. You think the government would do something about these pharmaceutical companies charging an outrageous price. I have to take the Brand, which I have been taking for 20 years. Tried numerous generics and it didn’t work. My insurance does not cover the brand drug.