The Insys that investors loved and that made its founder and chairman John Kapoor a billionaire is going away and, despite heroic efforts by company officials to rebrand it as a research and development-driven shop, its future will probably be less profitable, with little of the mercurial growth and compounding profits that defined its first four years.

The Southern Investigative Reporting Foundation interviewed two dozen then-current and former Insys Therapeutics sales staff, as well as six doctors and their staff, and their accounts paint a uniformly grim picture of the company’s prospects.

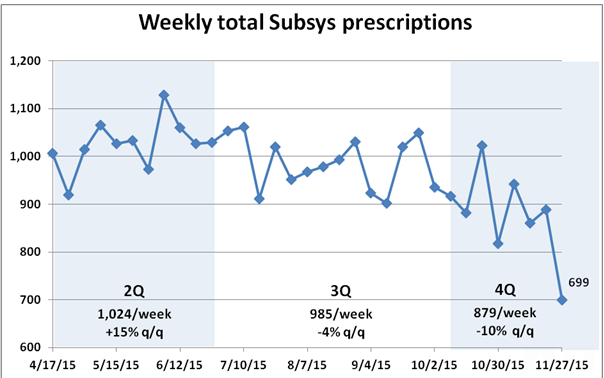

Its forecast is murky because the number of prescriptions for Subsys, Insys’ sole commercially viable product, is dropping and likely to continue to do so.

The forces arrayed against Insys, from a federal grand jury investigation in Boston to, as described in a Dec. 3 Southern Investigative Reporting Foundation story, mounting insurer scrutiny of Subsys prescriptions, represent brutal, if not possibly insurmountable, obstacles. A quick glance at Insys’ financial filings from 2012, when it was committed to marketing primarily to oncologists, is proof that playing by the rules is not very lucrative.

IMS Health data through late November, though, shows a 10.4 percent decline quarter to quarter in Subsys prescriptions. Even allowing for the traditionally soft Thanksgiving week, this is a grim trend for a company that regularly receives about 99 percent of its sales from Subsys.

Dan Brennan, Insys’ new chief operating officer, seemed to reference the drop-off when he tried to rally the troops at a Dec. 3 analyst presentation by alluding to some unspecified “commercial opportunities . . . that can stabilize and grow scripts.”

Insys’ decidedly mixed third-quarter earnings report offered a clear sign of the company’s headaches. The seemingly impressive third-quarter revenue figures were boosted by $6.6 million in distributor shipments, which risk “stuffing the channel,” decreasing future sales and profits. More positively for the company’s prospects, lower unit demand of about 5 percent was offset by an $8.4 million gain from diminished rebate amounts and higher drug prices.

Absent this $8.4 million benefit, Insys would not have been able to report $91.3 million in revenue, allowing it to claim that it had beat the brokerage community’s $83 million consensus estimate.

Flagging sales, however, are nothing compared to what the looming Department of Justice settlement negotiations might bring.

Ready comparisons for Insys’ situation are hard to come by. The only analogy might be Purdue Pharma’s 2007 $600 million settlement with the Department of Justice for intentionally misbranding OxyContin. (Three Purdue Pharma executives also pleaded guilty and separately paid a combined $34.5 million in fines.)

Brokerage firm analysts expect Insys to pay a fine and perhaps agree to amended business practices, a standard ritual over the past decade for U.S. businesses accused of wrongdoing. Despite some shockingly large fines and settlement, especially for pharmaceutical firms, the process of writing a huge check and issuing a guarded, conditional apology (without admitting or denying anything specific) is made more palatable for companies as investors often bid up their share prices on the view that “the bad news is now behind them.”

Research by the Southern Investigative Reporting Foundation suggests Insys’ case may be somewhat different.

Former employees say that about 90 percent of Subsys prescriptions were for off-label uses. This happened as a prior-authorization unit executive (and her supervisor) allegedly spent the past three years developing new and improved ways for employees to gull insurers with misleading patient diagnoses and codes, as the Dec. 3 article described in detail.

With the company’s achieving market-leading prescription-approval rates of 85 percent to 90 percent, the alleged scheme of Insys’ prior-authorization unit easily cost insurers hundreds of millions of dollars. They are unlikely to write off these losses without a fight.

Moreover, federal prosecutors will seek recovery on behalf of their employer, the U.S. government. Data obtained via the Freedom of Information Act shows that nearly 25 percent of Insys’ $576.5 million in revenue for Subsys since its launch, or $144.1 million, comes from Medicare and Tricare. While not every prescription was unlawful, with a potential fine of $10,000 per violation, the ones that were could result in an eight-figure company liability.

One saving grace for Insys may be its decent cash position at the end of the third quarter, with just a tad less than $94 million in cash and equivalents available and an additional $61.5 million in short-term investments.

The graph below captures what almost four years of Insys’ selling Subsys off label across the United States looks like.

Here the Southern Investigative Reporting Foundation plotted IMS Health’s prescription counts for Subsys adjacent to the FDA’s Adverse Events Reporting System data listing fatalities for which Subsys was listed as the probable candidate for triggering an adverse reaction.

This FDA data is not definitive, as it relies on informal assessments by medical professionals that are voluntarily reported. (An Insys press release last week took exception to the Southern Investigative Reporting Foundation’s reporting and offered its own interpretation of what the FDA data means.)

————————

For more than nine months the Southern Investigative Reporting Foundation has documented Insys’ freewheeling, compliance-light approach to selling Fentanyl. In the course of this reporting, it became clear that Insys’ approach to building and managing its sale force was both the key to its explosive growth and its subsequent woes.

The experience of Insys salesman Tim Neely, a 43-year old former fireman from San Clemente, Calif., is illustrative of how good intentions and honest ambition can be thwarted by a company’s drive for expanding earnings at all costs.

The Southern Investigative Reporting Foundation began talking to Neely while he wrestled with the company over a bereavement leave dispute in the late summer. In October Insys fired him. He has retained a labor lawyer and, in his words, “is examining his options.” In short, Neely is by no means a neutral observer.

Nonetheless, in addition to talking on the record, Neely provided documents, texts, emails and personal notes taken during calls with managers. Anything he discussed was checked with current and former Insys sales reps and managers, several of whom also provided documents. Finally, a reporter spent four days in California and confirmed and corroborated his account.

All signs point to the fact that Neely was a very good sales rep for Insys.

Based on the value of prescriptions, he ranked within Insys’ top 15 sales representatives last year, an achievement good enough to place him in the “President’s Club,” with one perk being an all-expenses-paid Mexican beach junket with other sales leaders. This is noteworthy considering the fact that he began selling pharmaceuticals only in October 2013.

Neely told the Southern Investigative Reporting Foundation that he earned $207,000 last year and, based on the documents he provided, he was on track to earn $170,000 to $180,000 this year.

A proud daily surfer, Neely would tell beach buddies and his family in emails and texts that he had taken a lot of risk leaving the job safety and camaraderie of the firehouse for Insys but that he was doing well and felt good about helping people who were in pain.

But late last summer Neely changed his mind in a big way about Insys.

While remaining a “true believer” in Subsys’ potential as a drug (a broken back a few years ago made him an expert on breakthrough pain, he said), Neely started to become troubled about the integrity of Insys’ management.

Neely said he felt management pushed the sales force to market Subsys “to anyone with a prescription pad.” Anyone who disagreed with that approach, he said, “was treated like garbage” and eventually fired.

His customers were several veteran surgeons who prescribed Subsys with regularity. Based on Neely’s documents and notes, he did what Insys trained him to do — become nearly indispensable to his clients. He instructed patients on the proper use of the drug in doctors’ offices and worked to overcome numerous impasses between patients and insurance companies. His doctors liked him enough to regularly allow him inside their office suites if he needed to make calls to schedule other appointments.

Like many a sales rep in any field, Neely hustled to keep his doctors happy. In one case, Neely arranged the weekly rental of a Beverly Hills basketball court for a regular pickup game with a doctor and his friends; in another, he celebrated a doctor’s birthday with sushi and tickets to a Los Angeles Kings hockey game.

And plenty of prescriptions were written, so much so that Neely said he takes pride in never having asked a doctor to prescribe the drug. The prescriptions were (usually) for cancer and postoperative trauma patients, keeping him far away from legal headaches.

But, as he described it, that wasn’t good enough. Insys’ management wanted more and wished him to somehow try to persuade the doctors to move the prescribed dosage to 800 or even 1,200 micrograms, even if the patient was doing well at 400. To Neely, doing so was destined to hurt patients and strain lucrative relationships.

“Serious doctors don’t want criticism on their dosing [protocols] from a sales rep and they don’t need [Insys’] speaker program money,” Neely said. But “the crappy ones” will and do, he added. “There’s just a point where you can’t sell more Subsys without crossing some lines. It’s not a [skin care] product; it’s not like other drugs.”

Neely and other former Insys reps described the pressure to constantly land new prescribers as unrelenting. Company departures became the norm, with many seasoned pharmaceutical sales reps leaving within weeks of being hired.

The pressure to generate sales revenue often reached absurd levels, according to one former Insys sales manager who for a decade had sold pain-management drugs at other companies. He said the sales leads the company gave his representatives were culled from a database like the yellow pages and had no connection to pain management or oncology. At varying times, his reps were asked to call on a naturopathic healer, a self-described shaman, several chiropractors and a nurse midwife, none of whom were able to prescribe Fentanyl — let alone needed to, he said.

His complaints to management were ignored. After concluding that there was no real business plan, this sales manager resigned three months later.

Another distinctive feature of life at Insys, Neely said, was adapting to what he described as a form of corporate schizophrenia: “Sales training and company-wide phone calls would be by the book, exactly like Merck or someone might do. Then your [district and regional] managers would pull you aside and tell you, ‘Don’t worry about that. Just sell. Do what you need to do.'”

The “say one thing, do another” culture became apparent early on to Neely.

During his training week, after a series of discussions on Subsys’ chemistry, how it compared to rivals and its place within the transmucosal immediate release Fentanyl marketplace, Neely and his sales trainee colleagues were told they were taking a test the next day — and failure would result in dismissal. A few hours later, a regional manager emailed them the answers to the exam — and the group was taken out drinking until the early morning by sales managers.

A core part of Insys’ sales training involved discussion of the company’s policy against wining and dining prescribers. Shortly after attending that presentation, a still green Neely wound up one night with a prescribing doctor (and his troop of thirsty friends) drinking and smoking cigars at a swank Beverly Hills club. The $530 bill was handed to him straightaway and he paid.

Pharmaceutical companies now disclose what they spend on physicians, either in terms of speakers program fees, research payments or hospitality, per the Physicians Payment Sunshine Act. No record of Neely’s boozy evening has been disclosed.

A few days after his Los Angeles outing, a district sales manager, Darin Cecil, told Neely that since that doctor was a good prescriber, the company kept a credit card available to help pay for just those expenses. Cecil told Neely that this had to be done “quietly” (he was given the card number via a text message) but a sales rep could use it to order sports and concert tickets. And a sales rep could be reimbursed for other events, too. Just as long as prescriptions were written afterward, Neely was told, no one would have any problems with the practice.

Through this hidden reimbursement channel Neely expensed thousands of dollars in entertainment charges — and he was not the only one, according to his former Insys colleagues. Neely said he was led to believe that then CEO Michael Babich knew about the practice but Neely was instructed to never bring it up publicly.

Neely was reimbursed for his charges every time.

————————

While Neely might not have been aware of what other sales reps across the country were doing to sell Subsys, he readily said, “I certainly felt some of the stuff [management] said was OK to do was probably not.”

One controversial practice that Neely described was the following: Sales reps were told to seek permission from staff in doctors’ offices to go through patient files looking for likely Subsys candidates, which, depending on the circumstances, could be a violation of patient privacy standards under the Health Insurance Portability and Accountability Act.

“They treated HIPAA like it was a joke,” Neely said, describing how sales reps, managers and their assistants regularly sent one another emails discussing patients’ treatments, including their diagnoses and dosages. Neely’s files are indeed full of Subsys user data.

Insys had some reasons for that. The prior-authorization program allowed Insys access to patient data so the company could try to secure insurer payment — and the sales rep was usually the point of contact for the patients, telling them when coverage was approved, about next steps, or if coverage was declined, how to initiate an appeal.

The procedures before the weekly sales conference call in Neely’s district illustrate how Insys’ real-time data collection, when combined with the patient disclosures from the prior-authorization program, could lead to potential disclosures of personal health information, according to Neely. Prior to the start of the call, Neely’s district manager would send an email detailing a list of prescriptions that had not been renewed or picked up or that had been canceled, indexed by the prescribers’ names. The idea was that the sales rep would call the prescribers to try to work for a renewal of the prescription or reverse a cancellation.

What was unsaid was that the sales reps likely knew — or at least could take an educated guess about — the names of many of those patients from the prior-authorization process. This led to, in several instances, sales reps’ contacting the patients directly and encouraging them to ask the prescriber for another, stronger Subsys prescription.

Then there were the episodes so far outside industry norms that they appeared surreal to Nealy.

At a cocktail party during a 2014 sales retreat, according to three of the attendees, one sales manager told her colleagues about an NBA star who had been prescribed Subsys for postoperative pain. This revelation stunned those who had heard it into silence until one wag remarked, “Well at 800 micrograms for 90 days, I guess, he won’t be back for the playoffs.”

In another instance, the Southern Investigative Reporting Foundation obtained a text from a pharmacist who sought a manager’s help locating an Insys sales rep named Brook Spangler. The text described how Spangler had purportedly — and inexplicably — been given a patient’s Subsys prescription but had not dropped it off.

(Contacted for comment, Spangler denied every aspect of the story: “I have never had a patient script in my hands, ever.” When read the contents of the text, she said it was a mistake. Messages left for the pharmacist were not returned.)

————————

The Insys executive who suggested examining patient files — albeit with the permission of office staff — and the biggest proponent of using a so-called secret credit card for entertainment expenses was national sales chief Alec Burlakoff.

Burlakoff’s vision for sales reps at Insys pushed the boundaries of pharmaceutical sales. He wanted them to be so integral to the patient’s experience with Subsys that a doctor would not think of prescribing other drugs. Sales representatives who had worked under him said his rationale for searching through patient files was that it was a win-win proposition: Insys could get additional prescriptions written and the doctor could receive speakers program fees.

A man of incalculable energy and a dynamic speaker, Burlakoff has been a frequent focus of Southern Investigative Reporting Foundation reporting on Insys. His effect on new sales reps was, as Neely put it, “incredibly powerful.”

Also powerful was the effect of his sales policies upon Insys’ income statement. As Burlakoff departed in July, annual sales were anticipated to be $300 million; when he became sales manager in early 2013, the company had just reported about $16 million in revenue.

By the time Burlakoff was lecturing Neely’s late October 2013 training class on his sales views, his strategy was generating tremendous returns in the form of double- and triple-digit quarterly sales increases. So when he spoke, everyone at Insys listened.

“If you can keep [patients] on [Subsys] for four months, they’re hooked,” Burlakoff told Neely’s training group. “Then they’ll be on it for a year, maybe longer.”

(Privately Neely would ask him if by “hooked” he meant addicted. In reply, Burlakoff gave him a puzzled smile and would only say, by way if clarification, “It’s not addicted if [the patient] is in pain.”)

Like many sales managers, Burlakoff used pop cultural references to drive home his goals. In an early 2014 sales meeting that Neely attended, Burlakoff told a group of several sales reps that if they hadn’t seen the then newly released movie “The Wolf of Wall Street,” they needed to see it right away.

Burlakoff said, according to Neely, “It’s the best sales training video in history” (although carrying out its lessons could result in federal prison sentences.)

Another video that Burlakoff found inspiring was something he showed Neely toward the end of his training week. In a break after a session, Neely was pulled aside and shown a video of a man using a dildo to pleasure a woman. After the smartphone-shot clip ended, Neely found himself speechless.

“Alec,” he said, “what’s that about?”

To which, Neely said, Burlakoff only smiled and walked away.

Burlakoff had a very specific vision about the people he wanted at Insys.

For instance, Burlakoff rejected the framework of hiring and training practices of what he derisively called “Big Pharma.” He preferred to hire salespeople who were used to the pressure of having to make quota or face dismissal; prestigious colleges weren’t very important for that skill set. A sales rep who needed to get three prescriptions written in four days (or else) would push Subsys without dwelling on too many other things.

Because all that Burlakoff valued was sales — generating prescriptions — he made rather unusual hiring choices.

In April, for instance, the Southern Investigative Reporting Foundation reported on his decision to hire Sunrise Lee and make her sales chief of the Midwest region. They had known each other when Lee worked as a stripper in Miami and apparent escort agency owner. Lee’s Insys job centered largely 0n socializing with prescribers. Burlakoff described Lee’s professional skill in serving as “more of a ‘closer.'”

Burlakoff hired numerous women for key sales roles. As is the case at many pharmaceutical companies, the women were uniformly attractive and several had unique backgrounds. There was Amanda Corey Emhof, a former reality-TV show star who had won $477 on an episode of “Judge Judy” and had once considered becoming a sex therapist.

Prior to selling Fentanyl, Emhof posed for Playboy [NSFW]. She co-founded Thrive Model Management, a business that provided models for marketing campaigns and private parties where she heads “model managing.” Reached on her cell phone the day before Thanksgiving, she declined to comment.

Insys’ apparent practices of hiring women based on their looks, with extraordinary economic incentives to sell the drug, resulted in a good deal of extracurricular sales rep-doctor relationships complicated by sex. None more so than in 2013 when the wife of a high-volume Subsys prescriber found a revealing photograph of an Insys sales executive on his phone. Since she lived not far from headquarters, she drove there and raised a ruckus; she was assured that all appropriate measures would be taken against the rep.

The sales rep was promoted soon after to sales trainer; the doctor no longer prescribes much Subsys.

While Burlakoff’s laissez faire sales approach led to a great deal of revenue, some take issue with its practices. Dr. Ken Bradley, a Torrance, California-based pain management physician, said that he disagreed with Insys’ sales approach.

“Not a lot of doctors are going to write a [prescription for a drug] whose rep doesn’t understand it very much and dangling speaker programs in front of them doesn’t make up for that,” Bradley said, referring briefly to a sales rep he had dealt with who had worked in auto leasing before joining Insys.

Bradley added that he had, upon joining a practice, “inherited several patients” using Subsys but that after their course of treatment was completed, he declined to further prescribe the drug. (To be fair, he said the drug worked as it was supposed to.)

“The high-pressure sales tactics became annoying and were just another reason to not deal with [Insys’] sales staff,” he said.

Dr. Bart Gatz, a Boynton Beach, Florida-based pain-management doctor with multiple offices, said that the regulatory and insurance headaches associated with prescribing Subsys have “made it impossible to prescribe.” He added that he didn’t think he had written five prescriptions for the drug this year.

Coming from him, that’s devastating news for Insys: Gatz was the sixth leading prescriber of Subsys under Medicare in 2013 and was Insys’ fourth highest recipient of speakers program fees in 2013 and 2014, collecting more than $154,000.

“I’ve seen this a few times before where a company just grows too fast and does stupid things, gets some doctors to write inappropriately and the feds come down all over them and everybody else,” Gatz said. “That’s what happened here. It’s over.”

Gatz added that he liked Subsys and that it worked well for patients who couldn’t swallow or digest easily during chemotherapy regimens, but authorizing insurer payments had proved so difficult this year that he had switched his patients off the drug.

Asked about his Insys sales representative, Gatz mentioned that “she hadn’t been coming around very much” since he stopped writing prescriptions for Subsys. He said that it was difficult beginning a dialogue with her about Fentanyl products given that her previous job had been working as a cashier at a Publix supermarket.

————————

Everyone named in this story was contacted for comment by phone, email and, if possible, text message — often multiple times.

Except where noted, no replies were received.

In all cases detailed messages were left about the nature of the Southern Investigative Reporting Foundation’s inquiry.

Insys Therapeutics, despite its profitability and current high profile, is unique in that it doesn’t have either an internal media relations staff nor an external advisor.

Calls seeking comment were directed to chief financial officer Darryl Baker, who did not return a call and text message sent to his cell phone.